What You Should Know About Bankruptcy Lawyer in Elgin, IL

If you’re struggling with debt and considering your options, consulting a bankruptcy lawyer in Elgin, IL, is a crucial first step. Filing for bankruptcy can seem overwhelming, but with the right guidance, it can provide a fresh financial start. A skilled bankruptcy attorney in Elgin, IL, helps you understand the process, protect your assets, and navigate the legal system efficiently. Bankruptcy is not just about eliminating debt, it’s about creating a structured plan to regain financial stability. Your attorney can explain the differences between Chapter 7 and Chapter 13 bankruptcy, help you understand which debts can be discharged, and guide you on exemptions that may protect your home, car, or retirement savings. They can also clarify how bankruptcy affects your credit score and what steps you can take to rebuild your financial health after the process. By working with an experienced professional, you gain the knowledge and support needed to make informed decisions and avoid common pitfalls that could complicate your financial recovery.

How Bankruptcy Can Impact Your Home and Foreclosure Timeline

Understanding how bankruptcy affects your home is essential when facing financial difficulties. Consulting a bankruptcy lawyer in Elgin, IL, can provide clarity on your options and help you protect your most valuable assets. Filing for bankruptcy can temporarily halt foreclosure, giving you time to reorganize your finances or catch up on missed payments. During a consultation, a bankruptcy lawyer in Elgin, IL, will review your mortgage, debts, and exemptions to determine the best strategy for your situation.

Here’s what you need to know:

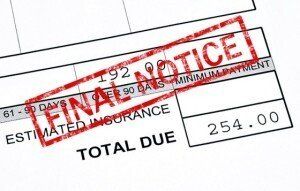

- Temporary Halt on Foreclosure: Filing for bankruptcy triggers an automatic stay, pausing foreclosure proceedings and creditor collection efforts.

- Protection of Assets: A bankruptcy lawyer in Elgin, IL, can advise on exemptions that may allow you to keep your home while discharging other debts.

- Customized Consultation: During your initial meeting, your attorney will review your financial situation, explain bankruptcy options like Chapter 7 or Chapter 13, and outline the potential impact on your home.

- Foreclosure Timeline Basics: Understanding the stages of foreclosure, notice of default, auction, and final sale helps you make informed decisions about filing for bankruptcy.

- Next Steps: After consultation, your attorney can guide you through the filing process, ensuring all paperwork is accurate and deadlines are met.

By consulting a bankruptcy lawyer in Elgin, IL, you gain expert guidance on protecting your home, understanding the foreclosure timeline, and creating a plan to regain financial stability.

Step-By-Step Guide to Filing for Bankruptcy

Filing for bankruptcy can feel overwhelming, but a bankruptcy lawyer in Elgin, IL can make the process much more manageable. Understanding each step helps you prepare and ensures your case moves smoothly.

Here’s a clear step-by-step guide to what you can expect when working with a bankruptcy lawyer in Elgin, IL:

- Initial Consultation: Meet with a bankruptcy lawyer to review your financial situation, debts, and assets, and determine the best type of bankruptcy for your needs.

- Gathering Documents: Collect all necessary financial documents, including income statements, debts, property information, and monthly expenses.

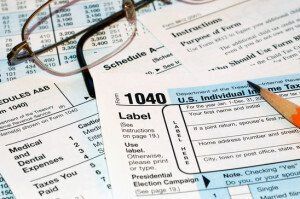

- Choosing Bankruptcy Type: Decide between Chapter 7 or Chapter 13 bankruptcy based on your financial goals and eligibility.

- Filing the Petition: Your attorney prepares and submits the required forms to the bankruptcy court, ensuring accuracy and compliance with legal requirements.

- Automatic Stay: Once filed, an automatic stay halts most creditor collection actions, providing temporary financial relief.

- Creditors’ Meeting: Attend the 341 meeting, where your bankruptcy lawyer will represent you and answer questions from creditors or the trustee.

- Debt Discharge or Repayment Plan: Depending on the type of bankruptcy, debts may be discharged, or a repayment plan is implemented to help you regain financial stability.

Frequently Asked Questions About Bankruptcy Elgin, IL

Many people have questions when considering bankruptcy, and consulting a bankruptcy lawyer in Elgin, IL can provide clarity and guidance.

Here are some of the most common questions clients ask:

How do I know if I should file for bankruptcy?

A bankruptcy lawyer can evaluate your debts, income, and assets to determine if filing is the best option for your financial situation.

Will I lose my home if I file for bankruptcy?

Depending on your situation and exemptions, a bankruptcy lawyer can help you protect your home while discharging other debts.

How long does the bankruptcy process take?

Chapter 7 typically lasts 3–6 months, while Chapter 13 can take 3–5 years. Your attorney will explain the timeline and help you plan accordingly.

Can bankruptcy stop foreclosure or repossession?

Yes, filing triggers an automatic stay that temporarily halts most collection actions, giving you time to work with your attorney on a solution.

How will bankruptcy affect my credit?

While bankruptcy may impact your credit score initially, a bankruptcy lawyer can provide advice on steps to rebuild your credit after the process.

If you’re ready to take control of your financial future, don’t wait any longer. Contact us today to schedule a consultation with a trusted bankruptcy lawyer in Elgin, IL, who can guide you through every step of the process. We’ll help you understand your options, protect your assets, and create a plan to regain financial stability.